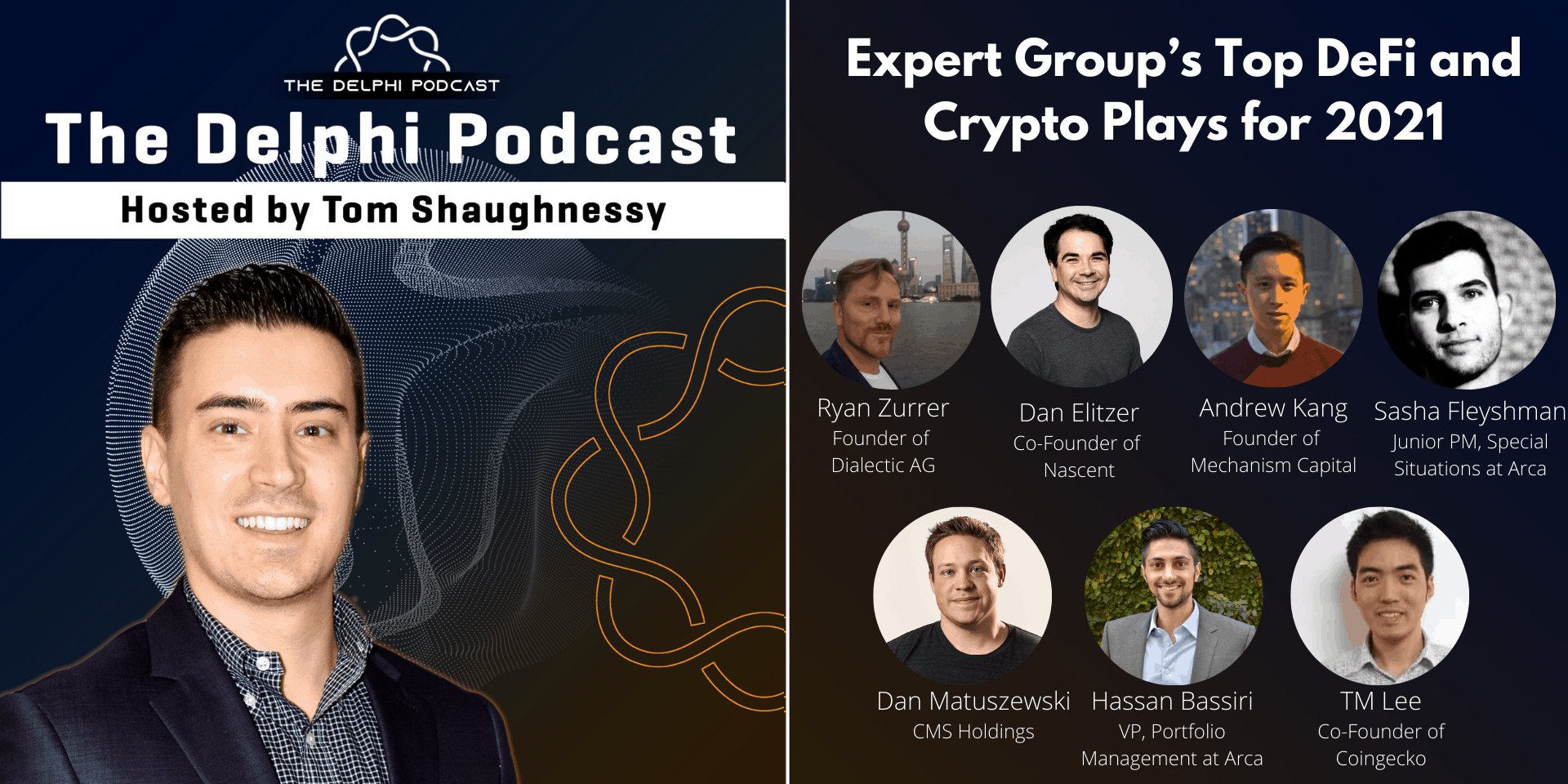

Expert Group’s Top DeFi and Crypto Plays for 2021

MAR 10, 2021

Disclosures: This podcast is strictly informational and educational and is not investment advice or

Delphi Podcast Host Tom Shaughnessy hosts an expert panel to discuss their top DeFi/Crypto plays for 2021.

This conversation originally occurred on Clubhouse (recorded with guest permission) and be sure to follow Tom Shaughnessy on Clubhouse for any future rooms!

- Ryan Zurrer – Founder of Dialectic AG.

- Dan Elitzer – Co-Founder of Nascent.

- Andrew Kang – Founder of Mechanism Capital.

- Sasha Fleyshman – Junior PM, Special Situations at Arca.

- Dan Matuszewski – CMS Holdings.

- Hassan Bassiri – VP, Portfolio Management at Arca.

- TM Lee, Co-Founder of Coingecko.

The full interview transcript is available below!

Every Delphi Podcast is dropped first as an audio interview for Delphi Digital Subscribers. Our members also have access to full interview transcripts. Join today to get our interviews, first.

Music Attribution:

- Cosmos by From The Dust | https://soundcloud.com/ftdmusic

- Music promoted by https://www.free-stock-music.com

- Creative Commons Attribution 3.0 Unported License

- https://creativecommons.org/licenses/by/3.0/deed.en_US

Resources:

- Tom’s Twitter: https://twitter.com/Shaughnessy119

- Delphi Podcast Twitter: https://twitter.com/PodcastDelphi

More

- Our Video interviews Can Be Viewed Here: https://www.youtube.com/channel/UC9Yy99ZlQIX9-PdG_xHj43Q

- Access Delphi’s Research Here: http://tatum.delphidigital.io/

Related episodes

DeFiGui Laliberte and Avichal Garg: Integral's Accounting Suite Driving Backoffice to Zero

Listen to the episode on Spotify:

DeFiTory Green: io.net’s 500,000 GPUs Powering Crypto x AI on Solana

Listen to the episode on Spotify: